Do you ever wonder how businesses can keep up with inventory demands without overstocking? Have you ever noticed that some businesses always have the right product on hand while others seem perpetually out of stock?

The answer lies in comprehending a key metric known as inventory turnover. By understanding this efficient process, any business can learn to better manage its stockpiles and create a successful and streamlined inventory plan.

In this post, we’ll explain everything you need to know about understanding and utilizing inventory turnover for your business. Read on to unlock the secrets of inventory efficiency!

What is Inventory Turnover Ratio?

The Inventory Turnover Ratio is a financial metric used to measure the productivity of a company’s inventory. It looks at how quickly a company has sold off its stock to make new orders to maximize profits.

This ratio can be used to evaluate how well a business manages its stock, reflecting its ability to produce income from sales and determine its liquidity status.

A higher number means that the business rapidly sells off products, making it more efficient and profitable. Conversely, a low inventory turnover ratio indicates that the company is not effectively utilizing its resources, which can significantly impact its bottom line.

Knowing this ratio is key for any business better to understand its performance and plan for future growth accordingly.

Understanding The Components Of Inventory Turnover Ratio

Understanding the components of the inventory turnover ratio is an essential part of financial management. The inventory turnover ratio measures how quickly a business produces and sells its products – the higher the ratio, the more efficient the operations.

The two components of the inventory turnover ratio are the cost of goods sold (COGS) and average inventory. COGS reflects how much was spent on inventory to make or purchase items for sale, while the average list shows how much was held in stock.

Understanding these two variables is key to helping managers make decisions about purchasing, production scheduling, and other areas of operations.

A strong understanding of the inventory turnover ratio can help a business increase profits by streamlining its processes and ensuring the right amount of product is available when needed.

Cost of goods sold (COGS)

Cost of goods sold, commonly known as COGS, is essential information for businesses and investors. Understanding how much costs are associated with the goods that a business sells is critical to assess profitability.

To determine this cost, businesses must accurately track their inventory, labor, taxes, and more to get an overall view of what it takes to produce the goods they sell. With this knowledge, they can make educated pricing, budgeting, and production decisions.

COGS can track progress over time in determining if the company is becoming more efficient in its production process or managing expenses better.

Average Inventory Value

The average value of inventory can be an essential part of a successful business. It helps determine how much the owner has invested and if they are making or losing money on those investments.

Knowing the average inventory value can help identify opportunities for streamlining costs, improving supplier agreements, and offering more customer incentives to increase sales.

Good inventory management can help a business maximize profits by using capital efficiently while keeping customers happy with the timely delivery of products.

It’s important to keep track of the average inventory value over time because it provides important data points into vital areas, such as purchasing costs and pricing strategies necessary for effective operational management.

Why Is Inventory Turnover Ratio Important For Businesses?

Helps to optimize inventory levels

Inventory turnover ratio is an important metric for businesses because it helps them to remain competitive and optimized.

This ratio can enable them to find the optimal balance between having too much inventory, which can cause a bottleneck in operations, and too little inventory, which can be detrimental if there is high demand.

The inventory turnover ratio helps identify areas where improvements are needed and highlights when stocks need replenishment. It’s critical for businesses to maintain updated transparency with their customers and use data-driven approaches that leverage the benefits of inventory management frameworks to remain profitable.

Ultimately, understanding how different inventory elements affect turnover rates is key for companies to optimize their levels so that sales efforts don’t go to waste due to shortages or surpluses.

Improves cash flow

Inventory turnover ratio helps businesses maintain a healthy cash flow by allowing them to evaluate their stock levels and the rate at which they buy, sell, and dispose of items.

Companies can use this information to decide when to purchase inventory and how much inventory needs to be on hand to meet customer demands.

Knowing the ideal inventory turnover ratio is especially important for businesses with limited capital, as it can help them manage costs while ensuring that customers have what they need.

In addition, having a clear picture of the inventory turnover ratio can alert companies to potential issues such as shortages or overstocking, allowing them to address problems before they become costly quickly.

Helps to identify inventory problems

Inventory turnover ratio is one of the most important metrics for businesses. It helps business owners understand how quickly their inventory is moving, allowing them to identify and address issues related to slow-moving inventory.

With a comprehensive view of their business’s inventory and how fast it is being sold, they can better plan upcoming sales campaigns, promotions, and restocking efforts.

Understanding their inventory turnover ratio also helps them decide about new products, prices, marketing efforts, etc. In summary, being aware of these shifts in the flow of goods is essential to maintaining profitability in any small or large business.

Supports decision making

Monitoring inventory turnover ratio is important for businesses as it gauges the overall efficiency of their sales activities. This metric helps businesses make decisions like investing in inventory and how much stock to carry.

A high ratio means that items are being sold quickly and efficiently, while a low ratio indicates inefficiency and problems with the stock. As such, executives can use this indicator to identify trends in the market that could be exploited to make better decisions regarding pricing, stocking, or marketing strategies.

Additionally, it can provide insight into unproductive product lines which require additional resources or should move toward discontinuation. Ultimately, its importance lies in its ability to direct decision-making by providing information about sales goals and measures to reach them.

How To Calculate Inventory Turnover Ratio

Calculating inventory turnover ratio can be an important tool for businesses to measure the speed of their inventory cycles. Understanding this metric can help managers understand how efficient their operations are and indicate how popular and in demand their products are.

To start, you’ll want to gather two pieces of information before calculating your inventory turnover ratio — the cost of goods sold and average inventory. This information will give you a better idea of how quickly stock is selling off and going through your system so that you can make necessary adjustments promptly.

Once you’ve gathered these two pieces of data, calculate the inventory turnover ratio, and divide the cost of goods sold by the average inventory.

Doing quick calculations like this regularly and understanding what stores need to have on hand at all times will ensure that your business operates efficiently and remains successful!

Using Inventory Turnover Ratio In Combination With Other Metrics

Inventory turnover ratio provides key insights into a company’s operations. Still, when combined with other metrics such as GMROI, DSI, and GMP, it provides a much more detailed overview.

By combining these metrics during an analysis of a company’s inventory and sales activity, companies can get an accurate snapshot of their stock control and view how high prices or low sales impact their margins.

GMROI helps owners understand how their profits correlate to the average inventory cost. DSI reveals how long products are held or stored in a warehouse before they are sold, making all metrics essential in understanding overall performance.

Coordinating the data gathered from each quickly highlights areas that need improvement and can lead to better practice in the future.

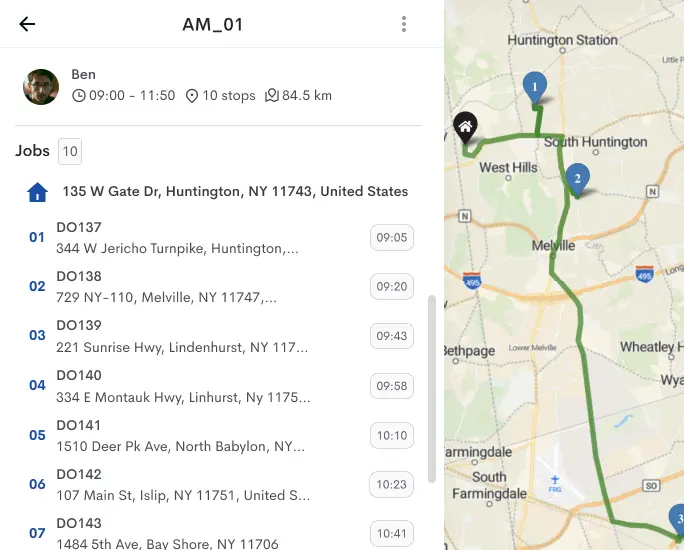

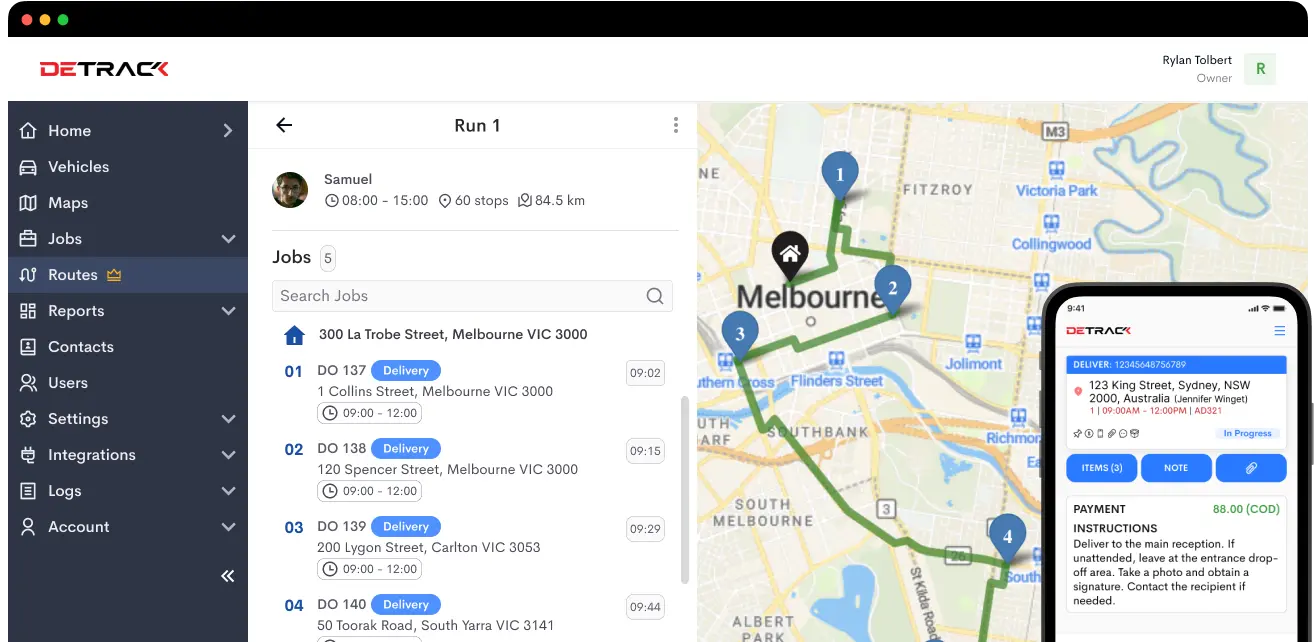

Optimize Your Process With Detrack

Good inventory management is essential to keeping your business profitable. By understanding inventory turnover, you can ensure you always have the right amount of inventory on hand.

Too much inventory ties up cash that could be used elsewhere in the business, while too little inventory can result in lost sales.

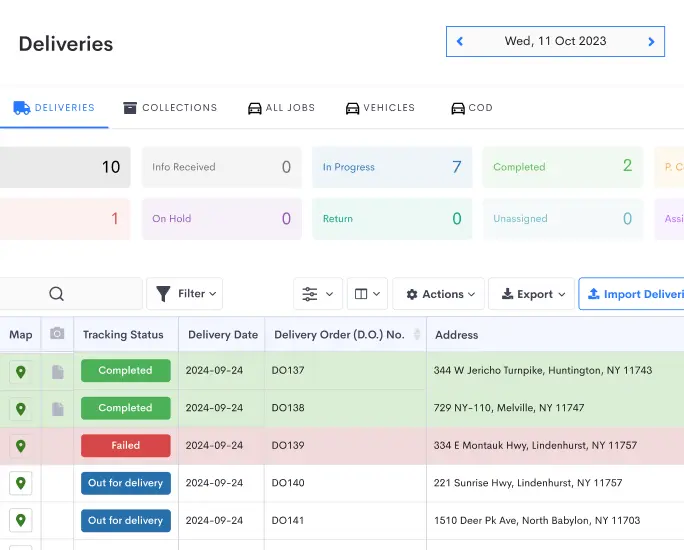

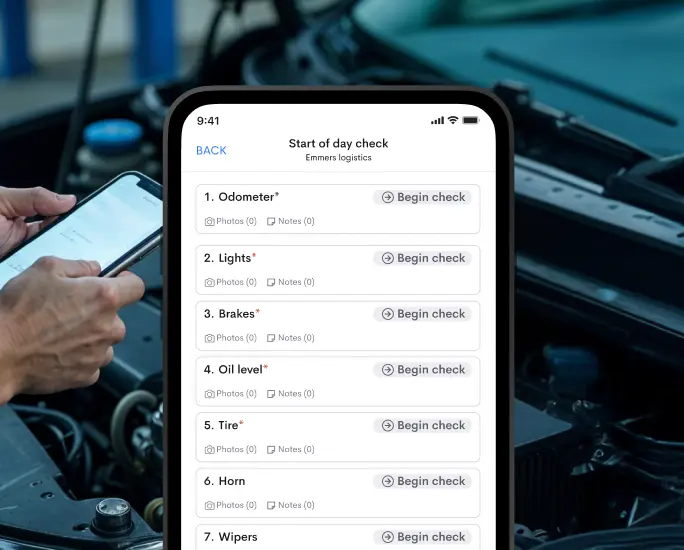

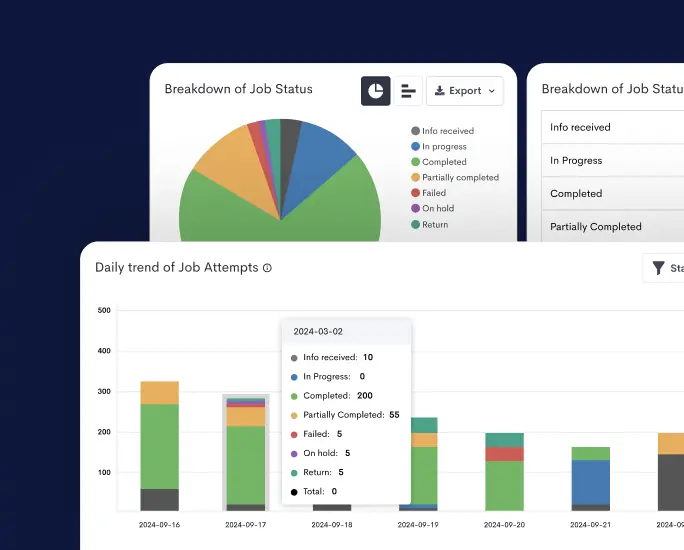

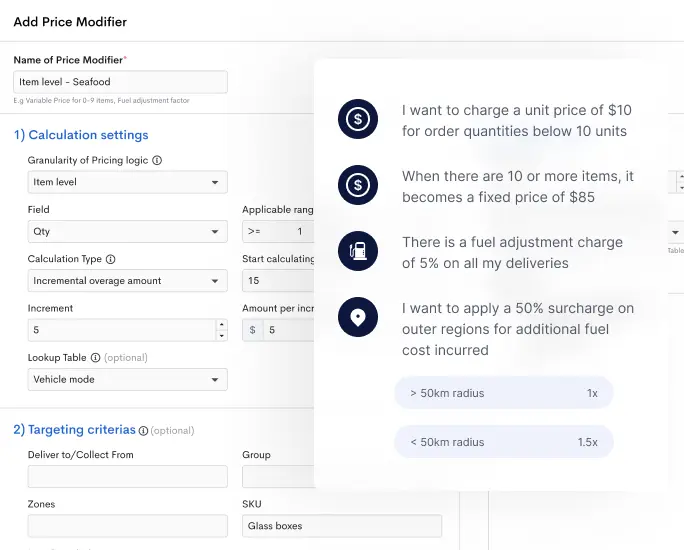

If you want to increase your inventory management efficiency, Detrack can help. Our advanced technology streamlines your last mile delivery processes, giving you real-time insights into your inventory movements. With our tools and analytics, you can easily predict repetative orders and topping up your inventory levels for maximum efficiency.